Want to Open Hajj Saving? Follow this Step

By Opini Ummah | 26 May 2025 10:32:07 | 200 | 0

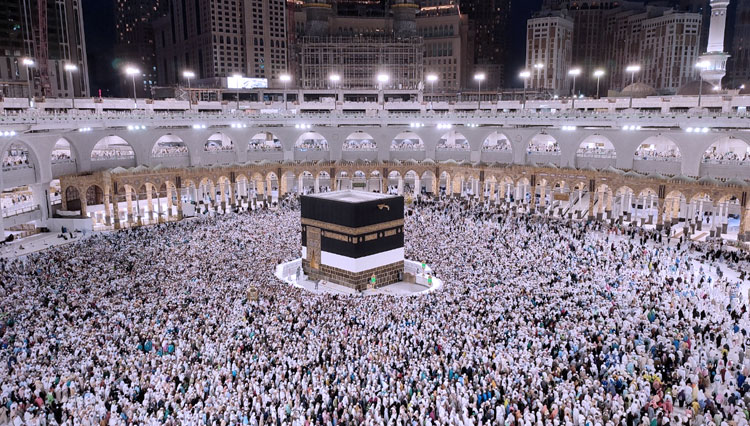

Worship to the Holy Land, or Hajj is a mandatory worship for muslims who are able. Therefore, for those who intend to perform Hajj, the first step must be done is to know how to register hajj, including how to open hajj savings. Because, having hajj savings is one of the conditions to be able to go to Hajj.

There is a minimum limit on the amount of savings that must be owned as reported by Lifepal. For those who want to register hajj savings in the bank, the minimum funds that must be in the minimum hajj savings is 25 millions rupiahs.

The regular hajj requirements for the initial deposit of BPIH to the Account of the Minister of Religious Affairs is 25 millions rupiahs. That way, you will also get the certainty of departing or portion number. Commonly, hajj savings are provided by sharia banks.

To open an account, of course you need to come to the bank with the necessary documents. Here is a simulation of the requirements of hajj savings documents:

* Fill out the account opening application form.

* Attach a photocopy of identity such as ID card, driver's license, or passport.

* Attach a photocopy of NPWP

* Initial deposit of IDR50,000 (minimum)

* The cost of closing a free account if a full deposit has been reached BPIH and 50 thousand rupiahs if it has not reached the full deposit of BPIH.

After the hajj savings are completed, the bank will help register it in Kemenag. The bank will then provide a sheet to the customer containing what are the requirements needed as a way of registering regular hajj at the Ministry of Religious Affairs office

All documents of these requirements will be taken to the Kemenag office in accordance with the address on the KTP.

Popular News

-

By Melissa Kumalasari Djiono 24 October 2025 08:20:21

1st batch of exhibits arrives at main venue for CIIE in Shanghai

-

By Melissa Kumalasari Djiono 13 October 2025 08:56:59

This Year Marks The 100th Anniversary Of The Founding Of The Palace Museum

-

By Opini Ummah 07 October 2025 11:02:43

Media Ummat Berduka: Pendiri dan Penasihat, Drs. H. Soeroto, SH, Tutup Usia dalam 83 Tahun Pengabdian kepada Dunia

Latest News

-

By Melissa Kumalasari Djiono 24 October 2025 08:20:21

1st batch of exhibits arrives at main venue for CIIE in Shanghai

-

By Melissa Kumalasari Djiono 13 October 2025 08:56:59

This Year Marks The 100th Anniversary Of The Founding Of The Palace Museum

-

By Opini Ummah 07 October 2025 11:02:43

Media Ummat Berduka: Pendiri dan Penasihat, Drs. H. Soeroto, SH, Tutup Usia dalam 83 Tahun Pengabdian kepada Dunia